SECTOR FOCUS

AG TECH & GREEN TECH

Services and products addressing sustainability and efficiency, particularly when it comes to agriculture. We are interested in startups who are changing the world through reducing waste, improving energy efficiency, and creating systems that are self-sustaining.

CONSUMER PRODUCTS

Services and products that will be purchased by individuals rather than businesses. We are especially excited about startups who are addressing the needs of tomorrow’s consumer, staying ahead of shifting values while addressing demographic and resources shifts.

ARTIFICIAL INTELLIGENCE

Offerings that solve for an autonomous future through learning, prediction, and recognition. We are looking for startups that are shifting the paradigm and status quo, by rethinking industries, enterprises, and technologies.

STAGE FOCUS

SIZE

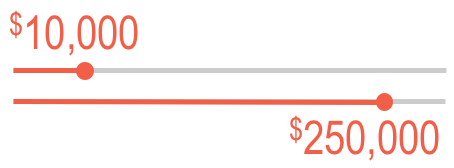

Since we target the pre-seed and seed stages, most of our investments are in the $10k – $25k range. This allows us to both take chances on unproven concepts and preserves our ability to invest in follow-on rounds for our portfolio companies.

TIMELINE

Our target investment cycle is 24-36 months. Great ideas take time to grow, and our aim is to develop our portfolio companies to the point that they are up and running on their own. That being said, as with our investment sizes, all opportunities are considered on a case-by-case basis, and we look to have an overall balanced portfolio.